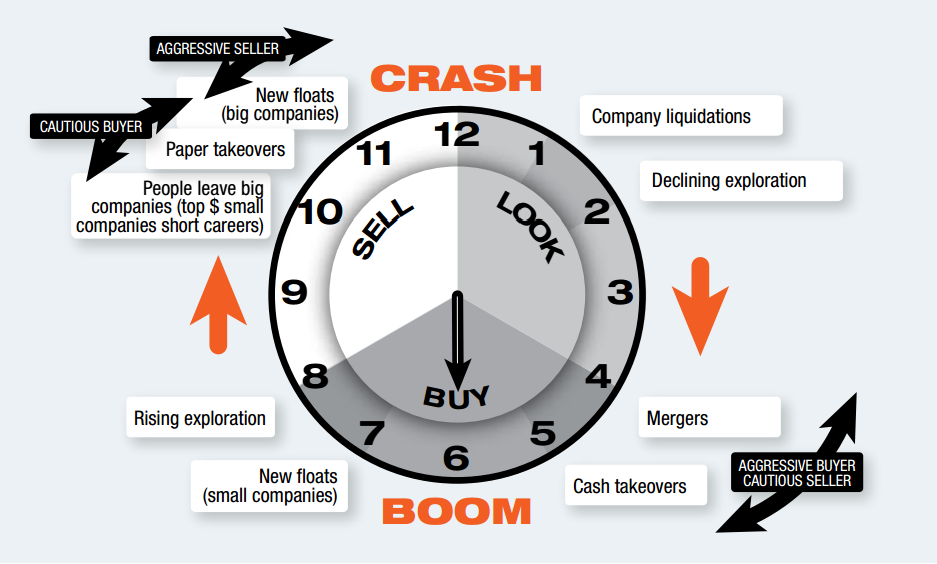

Lion Analyst in a group established in 1997 that aggressively provides a listed, expertly managed exposure to the high-risk/high-reward junior mining sectors. In their latest edition they have explained mining industry’s cyclical nature with a clock analogy and the article is indicating that the mining cycle is about to hit the peak.

The clock is divide into three sections that advises different actions for the investors: look, buy and sell. The first four hours (1 o’clock to 4 O’clock) represents “look” period. In this period, companies are liquidating and there is a decline in the mineral exploration. It is advised that in this period investors should start narrowing down their probable choices. Next four hours (4 O’clock to 8 O’clock) are the recommended “buy” period. In this period there are multiple mining company merges and cash takeovers. At the mid-point at 6 O’clock, the mining cycle is at the peak and it is referred as “Boom”. Right after the boom, there is rise in exploration and new smaller companies start to emerge in the market. The last period (8 O’clock to 12 O’clock) is the sell period, and it advised to sell your stocks. In this period, there is paper takeover and bigger companies start to emerge. 12 O’clock is the time when the mining market crash and the cycle restarts.

Currently the clock is at 5 O’clock and it is perfect opportunity for investors to start investing and the mining cycle is about to hit the peak. There are many evidences that supports this clause. In this way, after 5 years of downturn mining companies have outperformed ASX 200 by 14% year-to-date and recovery from a 16% fall in miners from 1st to 20th January. In addition to that, gold has been the best performing sector on ASX as it is 68% up , year-to-date. Moreover, IPO’s are beginning to restart and liquidity is improving on all measures. Furthermore, in 2013/14 money was raised in the market to issue papers in exchange for assets. In 2015/16 transactions are not heading towards balance sheet and funded deals. Lastly, high costs in the iron and coal have been slashed by the industry as a whole.